Best Online Brokers for Day Trading with Low Fees

Day trading is an exhilarating and often lucrative way to engage with the stock market. However, success in this fast-paced environment is not solely determined by skill and strategy; choosing the right online broker can be just as crucial. One of the essential factors to consider when selecting a broker is the fee structure. This article aims to explore the world of day trading, delve into the criteria for selecting an online broker, and review some of the top brokers, specifically focusing on those with low fees.

Understanding Day Trading

Basics of Day Trading

Day trading involves buying and selling stocks, options, futures, or currencies within the same trading day. Traders aim to capitalize on small price movements to generate a profit. Unlike traditional investors who may hold assets for weeks or months, day traders require quick decision-making skills and extensive market knowledge. They typically utilize technical analysis and charts to inform their trading strategies, as they often rely on rapid fluctuations in price.

To engage in day trading effectively, individuals need a reliable trading platform equipped with real-time data, charting tools, and advanced order types. This facilitates faster execution of trades, which is essential for capturing fleeting market opportunities. A solid grasp of market trends and indicators is also crucial, as day trading frequently depends on market conditions that can change within seconds. Moreover, successful day traders often develop a routine that includes pre-market analysis, where they assess potential stocks to trade based on overnight news and market sentiment. This preparation can be the difference between a profitable day and a loss.

Importance of Low Fees in Day Trading

Low fees are vital for day traders because success in this field often hinges on making numerous trades throughout the day. Every trade incurs costs, including commissions, spreads, and other fees, which can accumulate quickly. A trader making several transactions daily can see a significant dent in their profits if fees are high.

Choosing a broker with low fees can enhance overall profitability by maximizing the amount of capital that remains after expenses. This is why many traders actively search for brokers that have competitive pricing structures, such as zero-commission trades or minimal per-trade fees. Reducing costs allows traders to focus more on strategies rather than worrying about how much of their profits are being consumed by brokerage fees. Additionally, many brokers offer tiered pricing models that reward high-volume traders with lower fees, further incentivizing frequent trading. Understanding these fee structures can empower traders to select the best broker for their trading style and financial goals, ensuring they can maximize their returns while minimizing unnecessary expenses.

Criteria for Choosing an Online Broker

Trading Platform and Tools

The trading platform is the core of a day trader’s operation, and selecting one that is user-friendly and equipped with comprehensive tools is essential. A good platform should offer:

- Real-time data and analytics

- Customizable dashboards

- Advanced charting features

- Multiple order types for strategic trading

- Mobile access for trading on the go

Having these features can significantly enhance a trader’s ability to execute trades quickly and efficiently. Furthermore, a responsive and reliable platform is crucial to avoid technical disruptions during critical trading moments. Additionally, many brokers now integrate educational resources directly into their platforms, offering tutorials and webinars that can help traders refine their skills and stay updated on market trends. This can be particularly beneficial for novice traders who are still learning the ropes, as it allows them to gain insights and strategies in real-time while they practice trading.

Customer Service and Support

Reliable customer service is another critical factor in selecting an online broker. Day traders often encounter issues that require immediate assistance, such as technical support or account inquiries. A broker providing comprehensive customer service can make a considerable difference in the trading experience.

Look for brokers offering multiple channels of support, including live chat, phone support, and email. Additionally, check the availability of customer service hours; supportive brokers will often provide assistance during market hours, when traders are most active. Knowledgeable representatives can help resolve issues quickly, reducing potential downtime and allowing traders to stay focused on their strategies. Moreover, it can be advantageous to read reviews or testimonials from other traders regarding their experiences with customer support. A broker that is consistently praised for its responsiveness and helpfulness can provide peace of mind, knowing that assistance is readily available when needed. This level of support can be a game-changer, especially during volatile market conditions where every second counts.

Review of Top Online Brokers

Broker 1: Features and Fees

One of the leading online brokers for day trading is TD Ameritrade. It offers a robust trading platform known as Thinkorswim, which provides advanced charting capabilities and a wide array of research tools. With zero commissions on online stock trades and a plethora of educational resources, TD Ameritrade is an excellent choice for both beginner and expert traders.

While TD Ameritrade charges for some options and futures contracts, its overall fee structure remains competitive, making it an attractive option for active day traders. Additionally, TD Ameritrade’s commitment to education is evident through its extensive library of webinars, articles, and tutorials, which cover everything from the basics of trading to advanced strategies. This focus on education empowers traders to make informed decisions and enhances their overall trading experience.

Broker 2: Features and Fees

Another strong contender is Interactive Brokers. Known for its low-cost trading, Interactive Brokers provides access to a wide range of global markets. The platform features advanced trading tools and powerful analytics, catering especially to those who frequently engage in high-volume trading.

Though it has a slightly more complex fee structure, Interactive Brokers remains appealing due to its tiered pricing model, which rewards high-volume traders with reduced rates based on their trading frequency. Furthermore, Interactive Brokers offers a unique feature called “IBKR Lite,” which allows for commission-free trading on U.S. stocks and ETFs, making it an excellent choice for casual investors. The platform’s sophisticated trading technology, including algorithmic trading capabilities, also attracts professional traders looking to implement complex strategies.

Broker 3: Features and Fees

Rounding out the list is Charles Schwab, which has gained traction among day traders for its intuitive platform and zero-commission policy for online trades. Its research capabilities are robust, ensuring traders have access to insightful market data and analysis.

While Charles Schwab has a reputation for strong customer service and helpful resources, it is essential to review the potential fees associated with options trading, which could vary compared to its stock trades. Additionally, Schwab’s mobile app is highly rated, allowing traders to manage their accounts and execute trades on the go. The platform also integrates seamlessly with other Schwab services, such as retirement accounts and investment advice, making it a convenient choice for those looking to consolidate their financial management under one roof. With its commitment to client satisfaction and innovative technology, Charles Schwab continues to be a formidable player in the online brokerage landscape.

Pros and Cons of Each Broker

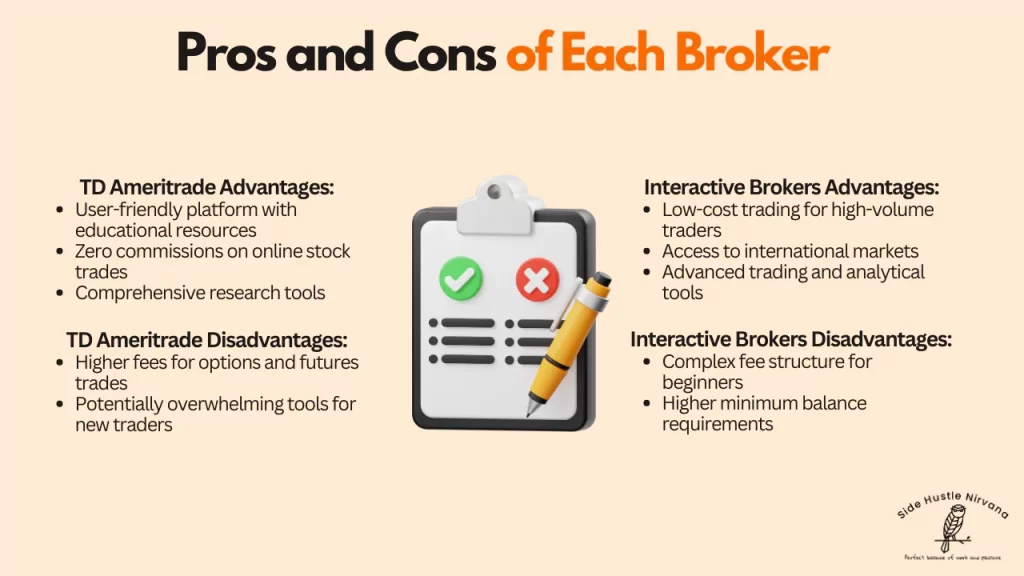

Advantages of Broker 1

TD Ameritrade’s main advantages include:

- A user-friendly platform with extensive educational resources

- Zero commissions on online stock trades

- Comprehensive research tools

Disadvantages of Broker 1

However, TD Ameritrade does have some disadvantages, such as:

- Higher fees for options and futures trades compared to some competitors

- Potentially overwhelming tools for new traders

Advantages of Broker 2

Interactive Brokers offers several benefits, including:

- Low-cost trading that can be particularly beneficial for high-volume traders

- Access to international markets

- Advanced trading and analytical tools

Disadvantages of Broker 2

Nevertheless, some disadvantages include:

- Complexity of the fee structure for beginners

- Higher minimum balance requirements

In conclusion, selecting the right online broker for day trading with low fees involves understanding your trading needs, evaluating the platforms and tools offered, and carefully assessing the overall fee structure. By considering the attributes of each broker, traders can make informed decisions to support their trading goals effectively.